Previously enamored tech stocks were not spared in the broader stock market slump. Aversion towards the technology sector has heightened as governments around the world expressed their concerns regarding the clout possessed by the big names. The unease over the inadequate regulations was exacerbated by the recent Facebook (NASDAQ:FB) data scandal. The impetus for additional scrutiny of the tech giants has contributed to an overhang for their stock prices.

I had previously written an article comparing Alibaba (BABA) and JD.com (JD) which turned out to be unexpectedly popular and became my most read piece. However, several readers messaged me to evaluate Tencent (OTCPK:TCEHY)(OTCPK:TCTZF) instead as JD.com is relatively much smaller and they are more comfortable investing in the larger players in the Chinese market. It is easy to understand their rationale for doing so. If even a globally recognized and highly visible company like Alibaba has been accused of wrongdoings, what more can be said of smaller ones like JD.com. Most importantly, the recent price correction in Tencent shares provided the opportunity for an entry for those who missed the spectacular appreciation. Hence, it is now apt to consider which of the two Chinese tech titans is a better buy, for those who only have the appetite to invest in one. Hopefully, this article helps make your decision-making easier.

Business Overview

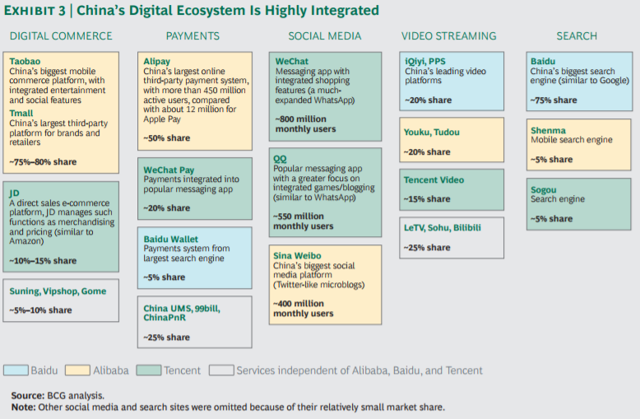

Consulting powerhouse BCG generated a very concise chart on China's digital ecosystem (see the exhibit below). In the chart, China's online space from e-commerce to social media and video streaming is mapped according to the brands' respective affiliation with the BAT trio (Baidu (BIDU), Alibaba, and Tencent). While Alibaba, in beige, is often coined the e-commerce giant, it clearly occupies a strong presence across all five categories of the digital ecosystem. On the other hand, Tencent, in green, is commonly referred to as a gaming and social media titan, but it is also formidable in each of the five categories. Of course, Tencent's leadership in the social media field is unparalleled whereas Alibaba is way ahead in the e-commerce sector. Readers need not be too fixated on the exact market share percentages as the landscape is very dynamic and vary quite a bit from time to time.

The two tech titans also have investments in a myriad of start-ups in the offline or semi-offline space. For instance, Alibaba and Tencent have joint ownership in Didi Chuxing (DIDI), the ride-hailing leader in China, together with other investors. Alibaba and its affiliate Ant Small & Micro Financial Services Group Co. Ltd. recently bought out the minority shareholders in Ele.me which is estimated by consultancy firm iiMedia to account for 41.3 percent of the market share. This enlarges its food delivery empire which already includes Koubei, another key delivery platform. On the other hand, Tencent is backing Meituan Dianping which holds the leading position at 55.3 percent. This leaves the remaining players in the market which grew by 23 percent in 2017 fighting for scraps.

Similarly, the pair is the dominant players for the ubiquitous shared bikes in the major cities in China. Tencent's claim to the throne comes in the form of Mobike while Alibaba is backing Ofo. An estimated combined market share of 95 percent between the two has been bandied about by the media.

Alibaba and Tencent are also competing by proxies. For instance, Tencent-backed JD.com has entered into similar businesses as Alibaba, whether in the form of modernizing convenience stores (mom-and-pop shops) or disrupting the property services industry. Alibaba's mapping unit, Autonavi, has recently announced its foray into the carpooling business, which could potentially extend into ride-sharing and compete head-to-head with Didi Chuxing, where Tencent has the controlling stake. Ultimately, the overriding purpose of having a presence in overlapping sectors is to protect their customers' usage of their payment services and capture more user data.

Tencent And Alibaba: Differing Ways To Domination

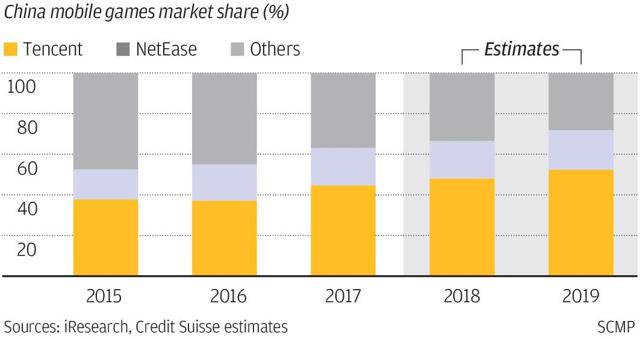

Separately, Tencent's main revenue driver is its gaming business which has been running a neck and neck race with its main competitor, NetEase (NTES). Nevertheless, Tencent is projected to come clearly ahead by 2019 as its mobile games market share grows by leaps and bounds. This is important as mobile games will account for around 80 percent of the online games market by 2019.

On the other hand, e-commerce is still Alibaba's bread-and-butter, though its side businesses like cloud computing look highly promising. The president of Alibaba Cloud is confident that it would "match or surpass" Amazon's AWS (AMZN) by 2019.

In terms of partnership with western firms, the duo is also active in that respect. Interestingly, their respective choice of their partners demonstrates the potential of achieving success in their own specialties, without the constant clashes in the same crowded fields. This is a good indication of a sustainable future which can accommodate the two tech behemoths.

Alibaba has paired up with Starbucks (NASDAQ:SBUX) to enable Alipay as a payment option in China and overseas such as Malaysia. Alibaba has also joined forces with Marriott International (NYSE:MAR) to integrate their respective loyalty programs and enhance the adoption of Alibaba's digital travel platform. It is even not adverse to tying up with brick-and-mortar players like CapitaLand to tap on the latter's property development/management expertise. Even though the media focused the hype on the gigantic vending machines used to market the cars, the partnership between Ford (NYSE:F) and Alibaba actually involved a collaboration in several ways, leveraging on the various business units of the latter.

Tencent has also embraced global leaders to enhance its own offerings. In January this year, it announced a deal with Google (GOOG)(GOOGL) to cross-license their patents portfolio and collaborate on future technology developments. Playing to its strength in gaming, Tencent is in a comprehensive partnership with privately-owned Lego to develop games and videos catering to the young consumers. The gaming giants are also exploring to launch a social network for children in China.

Valuation Comparison Between Alibaba And Tencent

Given the myriad disparate businesses, it is beyond the scope of this article to evaluate comprehensively the individual prospects of each. Hence, it is perhaps more appropriate to compare the two Chinese tech titans using reported financial numbers and selected operating metrics.

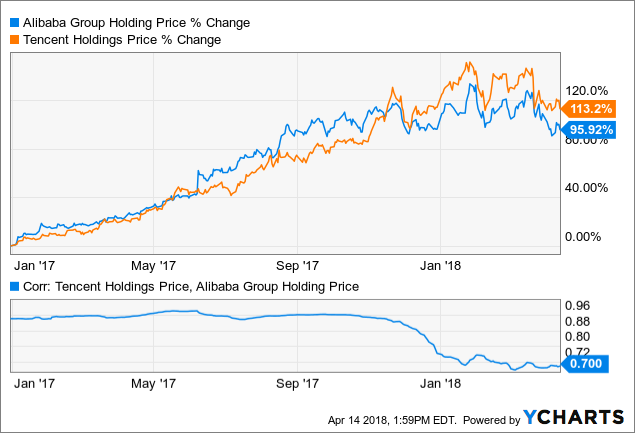

First off, let's take a look at the share price appreciation between the two. The stocks of both Alibaba and Tencent have performed well, although the latter has come out ahead for now. Since the beginning of 2017, the share price of Tencent has gained 113 percent while Alibaba rose 96 percent. Alibaba and Tencent had previously moved in lockstep (nearly) prior to around November 2017. Thereafter, the correlation between their share price movements has fallen from above 0.85 to around 0.70 (see the lower half of the chart below).

BABA data by YCharts

BABA data by YCharts

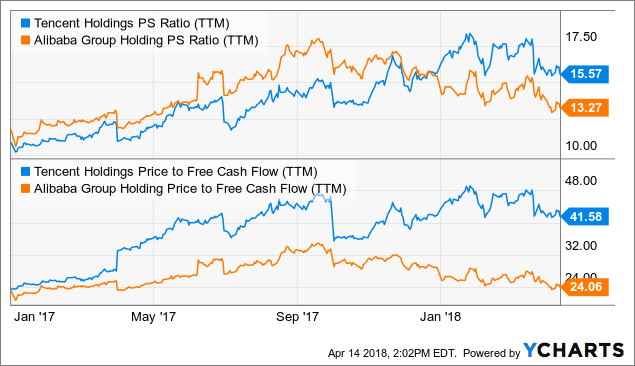

The media narrative has been that Alibaba's competitors are increasingly encroaching on its dominance in e-commerce and mobile payment. In contrast, Tencent's leadership in social media and gaming remains apparently unassailable. As a result, the market is now only willing to accord Alibaba with a price-to-sales ratio of 13.27x (on a trailing twelve-month sales basis), below that of Tencent's 15.57x. This is a reversal of trend since November 2017. The lofty price-to-free cash flow enjoyed by Tencent is also telling of the market's preference for Tencent versus Alibaba.

TCEHY PS Ratio (TTM) data by YCharts

TCEHY PS Ratio (TTM) data by YCharts

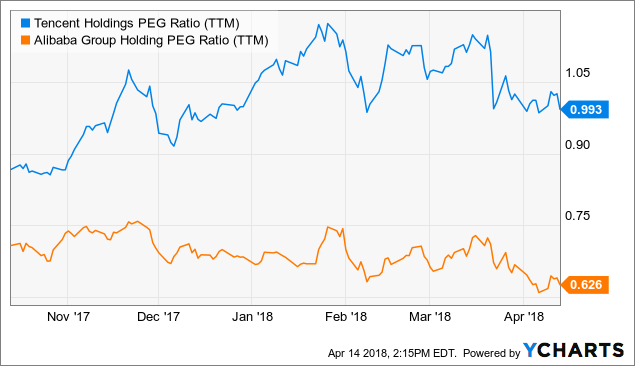

The price-earnings-growth ("PEG") ratio tells a similar story. Alibaba trades at a PEG of 0.626x while Tencent does so at more than 50 percent higher at 0.993x.

TCEHY PEG Ratio (TTM) data by YCharts

TCEHY PEG Ratio (TTM) data by YCharts

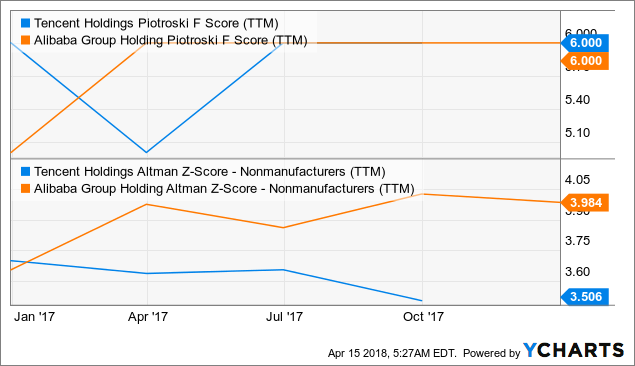

According to Investopedia, the Piotroski F Score is used to "determine the strength of a firm's financial position" and in turn "determine the best value stocks," with nine being the best and zero being the worst. It is a productive way to rank stocks as the criteria involve profitability; leverage, liquidity, and source of funds; and operating efficiency categories. Both Tencent and Alibaba managed to achieve a respectable Piotroski F score of 6.0, which is a testament to their financial strength. The duo also has healthy Altman Z-Scores. The Altman Z-Score is a decent gauge of the probability of a company going bankrupt. According to YCharts, the companies with a Z-Score of less than 1.81 have a relatively high probability of bankruptcy. Hence, at 3.506 and 3.984, respectively, Alibaba and Tencent are both well clear of that danger zone.

TCTZF Piotroski F Score (TTM) data by YCharts

TCTZF Piotroski F Score (TTM) data by YCharts

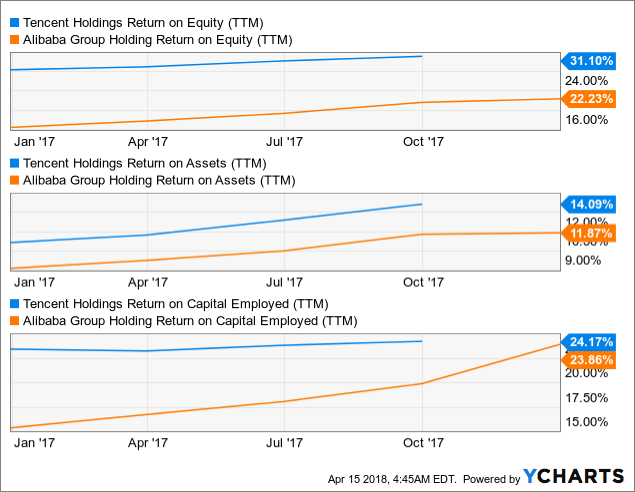

Finally, let's take a look at the calculations of returns. Tencent has comfortably outperformed Alibaba in terms of return on equity ("ROE") and return-on-assets ("ROA"). Nevertheless, on the metric I deemed to be more relevant - return on capital employed ("ROCE") - Alibaba is arguably on par with Tencent. My preference for ROCE is well explained by a write-up on gurufocus, where it states ROCE "gives a good indication of a company’s actual capacity to generate returns through utilization of its productive assets. Also, this metric can be used to compare companies employing varying capital structures".

TCTZF Return on Equity (TTM) data by YCharts

TCTZF Return on Equity (TTM) data by YCharts

Thus far, I have illustrated a very optimistic picture of the two Chinese colossals. Unfortunately, their large size and broad business interests have put them in the crosshairs of the Chinese authorities. Their relationships with the Chinese government can be both an extremely beneficial one and one to be treated with high caution.

Tencent scored a coup when the Chinese government decided to adopt its messaging app (WeChat) to host the national electronic ID system. This essentially cemented WeChat's position as the de facto platform for the government's digital initiatives and user stickiness to the app is virtually assured. However, Tencent did not reach its size today just by being a partner to the government. In fact, its business operations have at times incurred the wrath of the authorities. Just a couple of days ago, regulators instituted a temporary download ban of several apps including those belonging to Tencent and NetEase in an effort to clamp down on undesirable content.

Tencent's popular games have also attracted the attention of the authorities. A member of the Chinese People's Political Consultative Conference (CPPCC), the nation's top advisory body, called video games the new opium. That is a serious statement, given the first Opium War is regarded as the beginning of the “Century of Humiliation” in China. As a result, Tencent has to do the counter-intuitive measure of investing in anti-game addiction studies in an acknowledgment that being proactive beats getting disciplined by the government.

Interestingly, Alibaba's less domineering position in the social media field is a blessing in disguise. Still, its co-founder's penchant for media interviews exposes the company to potential slips that offend Beijing. To that end, Jack Ma has expressed on a number of occasions that he would stop short of elaborating or respond to certain questions that could put him and the company in a difficult position.

Conclusion

With both Alibaba and Tencent being so huge and having myriad businesses, this article is unable to decisively provide a definitive answer as to which is a better buy. Nonetheless, I hope what I have illustrated above have helped readers to answer the question better for yourselves.

With Tencent being the dominant player in the social media space, it is inevitable that the company comes into the crosshairs of the Chinese authorities. However, as long as Tencent can toe the imaginary line, it has a long runway tapping on the human being's desire for gaming and social interactions.

Alibaba's wide tentacles in the e-commerce space, spreading to the mobile payment and cloud computing bodes well for its future as a data behemoth in an age where data is king. Hence, fundamentally, both Tencent and Alibaba are poised to benefit from the growth story of Asia, if not the world. Personally, it is tough for me to decide between the two.

Price-wise, Tencent is trading well within a multi-year band as far back as 2009. The recent pullback is not surprising when viewed in this context as the share price hit the upper end of the band (see the chart right below for the resistance and support levels in green). Zooming in, the shares now appear to have bounced off the short-term support line (see the red line in the following chart). If the red short-term support line holds, Tencent's price floor is extended to $600 by the end of the year. If there is a harder fall, the stock could possibly still recover to $400 by the end of the year should it remain within the multi-year trading band (in green). The risk seems tilted to the upside.

Tencent's Price Charts (0700.HK)

(Source: Drawings by ALT Perspective, Chart from Yahoo Finance)

(Source: Drawings by ALT Perspective, Chart from Yahoo Finance)

As for Alibaba, I have already discussed the possible price movement in Alibaba: Where's The Bottom? In short, the multi-month support line at around $164 seems to be quite a solid one given that it has been tested several times in just the past few months, but it is by no means an absolute price floor. If the triangular price movement pattern is to continue, the stock looks to be heading for the hypotenuse and potentially a new high should it reach the resistance line (hypotenuse).

Alibaba Price Chart

(Source: Drawings by ALT Perspective, Chart from Yahoo Finance)

Not to confuse readers, but for those who intend to invest in Alibaba, you might wish to consider whether the ADRs is the instrument most suited for you. Altaba (AABA) is primarily what remains after Yahoo Inc.'s operating business was sold to Verizon Communications Inc. (VZ) on June 13, 2017. The key asset in Altaba is its stake in Alibaba. There are pros and cons to investing in Altaba rather than the ADRs. Others might also be more keen on riding the growth in Alibaba through SoftBank (OTCPK:SFTBF) (OTCPK:SFTBY), which holds a substantial stake in Alibaba. As for Tencent, investors could also consider investing in it through Naspers (OTCPK:NPSNY, OTCPK:NPSND) which has a 31.2 percent stake in Tencent.

No comments:

Post a Comment