IBM's (IBM) recent earnings showed its dissatisfying financial growth, while at the same time, many investors continue to be willing to pay hefty multiples for IBM's long-term promise of growth coming out of its strategic imperatives; I, on the other hand, remain unimpressed with its progress. With so many great investment bargains out there currently, post-recent tech sell-off, I fail to understand IBM's shareholder passion for staying invested here.

Recent Developments

My previous IBM article, back in October 2017, was titled, Market Overreaction To A Minor Improvement. An excerpt from that article shows how prescience it was:

IBM's shares soared on its Q3 2017 results. But was there anything really significant about its results? Not from my point of view. Sure, what IBM signposts as its Strategic Imperatives have performed well. These are business lines which focus on cloud, analytics and engagement. However, these businesses only amount to less than half of IBM's overall enterprise.

In the article, I argued that in spite of IBM's shares rallying strongly after its results that it would not be long before the market would once again penalize IBM; because what the market wants, at the end of the day, is growth; solid, predictable and sustainable revenue growth. IBM cannot offer investors what they ultimately seek. IBM’s most recent results, Q4 2017, proved that while its Q4 2017 results certainly improved from its trailing 9 months of 2017, it was not enough to satisfy the market and thus saw its share price once again come down.

In more detail, its Q4 2017 results showed that revenue was up 1% (adj. for FX), and its non-GAAP EPS was up 3%; which brought IBM’s FY 2017 non-GAAP EPS line to $13.80. However, I argue that paying up $153 per share ($140 billion mcap) for IBM, in the best case, makes it an investment at fair price. The vast majority of readers of this post have numerous better opportunities to invest in, both large caps and certainly amongst small caps. IBM remains full of passionate rhetoric, but once we ignore its PR speech and focus squarely on its outlook, the long-term opportunity becomes uninteresting.

Outlook

During its investor briefing, IBM highlights through a wonderful presentation the fact that its scale offers IBM strong operational leverage, and how its software-as-a-service is poised for steady growth.

Nevertheless, when it is all said and done, in the long term (with no mention, of course, on what long term means), IBM is likely to reach high single-digit EPS growth, which is not sufficient to support its current valuation.

Furthermore, IBM highlights that it will not only look to increase its dividend annually, but that its repurchases program is likely to reduce outstanding shares by 2%; which makes one think. They are deploying large amounts of capital into an undisputed fast growing industry - the cloud. Where its large competitors, such as Microsoft (MSFT) are seeing several quarters of Azure (Microsoft's cloud platform) grow at +90% YoY. Yet, IBM is struggling to match this market's explosive growth in its 'strategic imperatives' business lines, implying that IBM is a mature business with minimal growth opportunities. Also, because of its size, it takes IBM so much more for it to move the needle on its financials. And in spite of a lack of growth, its returns to investors are minimal.

Shareholder Returns

Excluding IBM's Global Financial debt of roughly $31.4 billion, IBM's debt totals $15.4 billion. With $12.6 billion of cash on hand to offset this debt, combined with its strong cash flow generating capabilities, offers IBM a solid financial position, which, for the purposes of our discussion, essentially makes IBM close to debt-free.

Having written about IBM in the past and spent time going over the comments in the article, I understand that many shareholders are investing in IBM 'for the long term' and that they are more than happy to collect the 4% dividend on its shares. However, I argue that if IBM continues to disappoint the Street, its share price could significantly come down, which would more than offset any potential gains from the dividend.

Valuation

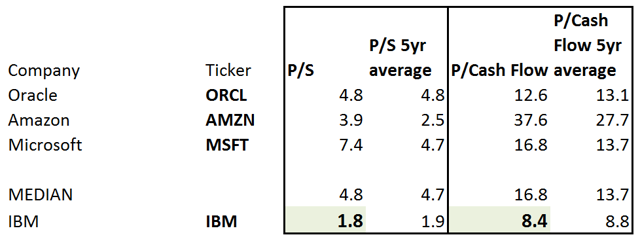

The table above reinforces my overall case that realistically IBM is being priced at fair value. IBM does not present investors with a bargain opportunity, and that what looks like a stable blue chip company, can have one or two quarters of earnings miss and its share price can aggressively sell off further.

Furthermore, if we compare IBM's historic P/Sales or P/Cash Flow ratio, we can see that IBM is currently being priced very close indeed to its own historical average - there is no real bargain opportunity present.

Takeaway

When all is said and done, the sell-off in the broad market in recent weeks is a reminder to all investors that there is no such thing as a safe investment. Many investors who had been making money easily in the long bull market might think that investing in IBM is a 'safe blue-chip' investment. However, there is no such thing as a safe investment in a publicly traded security.

Moreover, IBM's scale does not offer it any advantage. In fact, its scale only helps management feel prestige and able to command inflated salaries for managing a strong iconic 'empire', while the actual owners of IBM, its shareholders, are unlikely to be holding any gains in its stock. Furthermore, I continue to argue, as I have in the past, that IBM's legacy businesses continue to drag down its results, and that the best course of action would be to spin off its mature businesses and focus management's talent and IBM's financial resources on its smaller but higher growth businesses.

Disclaimer: Please do your own due diligence to reach your own conclusions.

Note: The only favor I ask is that you click the "Follow" button, so I can grow my Seeking Alpha friendships and our Deep Value network. Please excuse any grammatical errors.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment